Empower your busy directors who sit on multiple boards and committees. Aureclar provides portfolio-wide governance intelligence to support investment thesis monitoring, operational improvements, and exit preparation.

Support your investment professionals and portfolio company directors with sophisticated tools designed for multi-board governance and investment monitoring.

Support directors who serve on multiple portfolio company boards with unified governance tools that provide context across all investments.

Enhance investment committee effectiveness with comprehensive portfolio analytics, deal flow tracking, and performance monitoring tools.

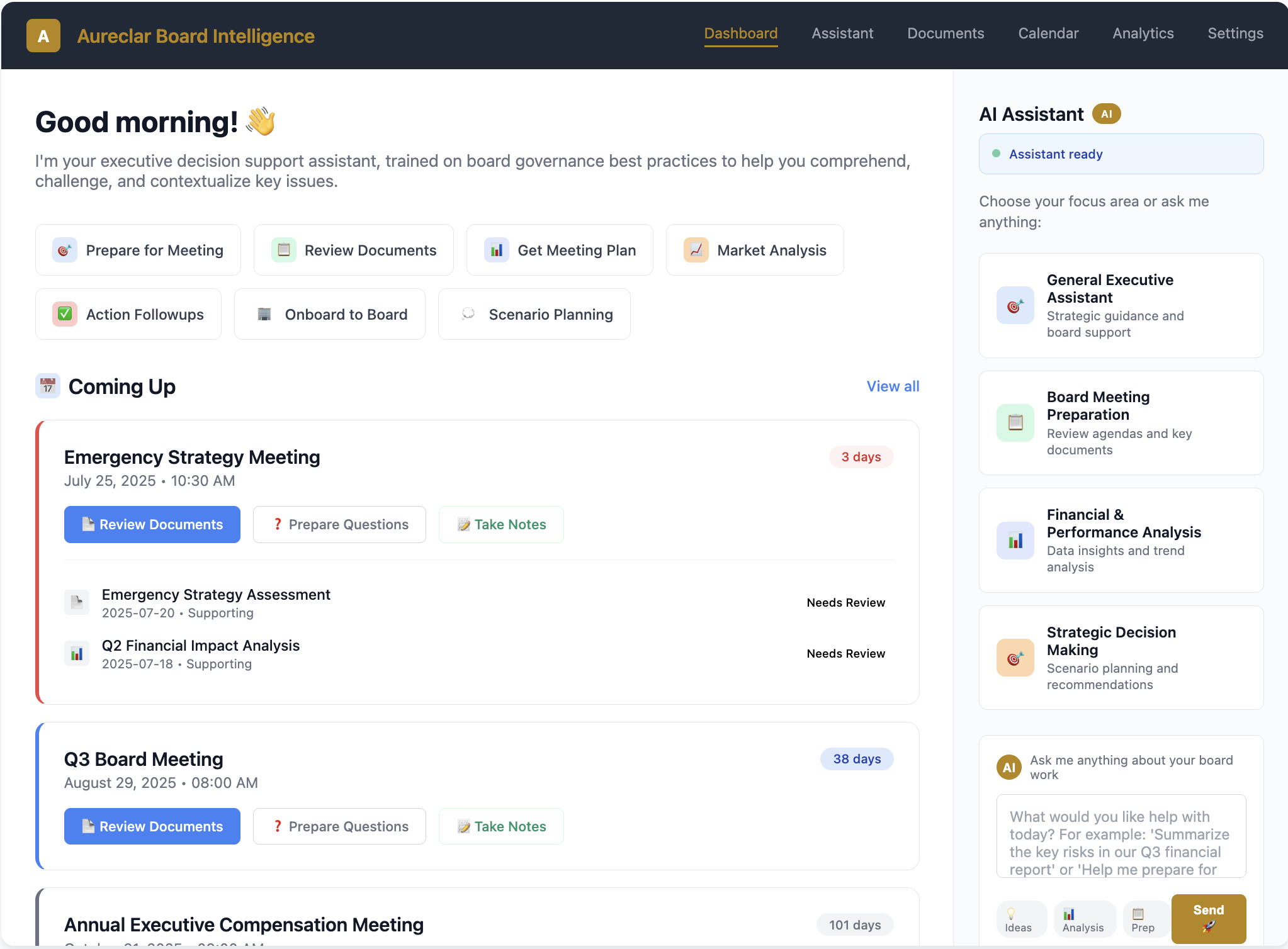

Streamline board preparation across multiple portfolio companies with AI-powered insights that help directors stay informed and engaged.

Track portfolio company progress against investment thesis with automated monitoring, milestone tracking, and value creation metrics.

Monitor operational improvements, financial performance, and strategic initiatives across your portfolio with comprehensive analytics and reporting.

Prepare portfolio companies for successful exits with IPO readiness assessments, due diligence support, and strategic exit planning tools.

Consolidated calendars and action items across multiple boards through our multi-organization support on the /orgs page.

Research investment opportunities, market trends, and portfolio company performance using external research and document analysis capabilities.

Organize and analyze documents across multiple portfolio companies with cross-portfolio insights and unified document management.

Extract and compare financial metrics across portfolio companies with external research for peer benchmarking and trend analysis.

Research exit strategies, IPO requirements, and due diligence processes using external research and document analysis capabilities.

Streamline investment committee preparation with document analysis, metrics extraction, and research capabilities for informed decision-making.

Join leading PE/VC firms who trust Aureclar to enhance portfolio governance and drive investment success across their entire portfolio.